Reverse Mortgage Huntington Beach

Get Your Reverse Mortgage in Huntington Beach With A Team That Cares...

Make Retirement A Whole Lot Easier!

Start Enjoying Your Retirement!

We can help you stay in your Huntington Beach home forever and not run out of cash!

- Access Expanded Financial Resources!

- Improve Your Home with Renovations and Enhancements!

- Create a Safety Net for Unforeseen Circumstances!

- Enjoy Tranquility and Security!

- Protect Your Family!

How A Reverse Home Mortgage May Help

Picture this: you skip your Huntington Beach mortgage payment and suddenly gain access to cash!

Receive Tax-Free Cash

Establish a Line of Credit for Life’s Surprises

Create a Stream of Income

Green Monarch is dedicated to providing exceptional personalized guidance on reverse mortgages in Huntington Beach. As a local, boutique-style, family-run lender, we place our clients' satisfaction as our highest priority! We empower our clients with the essential knowledge needed to make informed financial decisions for their families.

REVERSE MORTGAGE LENDER Huntington BEACH CA

Why Choose Us In

Huntington Beach?

At Green Monarch, we are proud to serve as a reverse mortgage lender in Huntington Beach, CA, providing customer support that is truly unparalleled in the industry. Our locally operated reverse mortgage company in San Clemente is a close-knit, family-run business. In contrast to larger banks and branches, our compact size enables us to maintain low fees, allowing us to offer you competitive loan rates along with personalized, one-on-one assistance. This guarantees that you feel assured in making the best financial choices for your family.

Whether you're exploring reverse mortgages for the first time or looking to refinance an existing loan to secure a more favorable rate, if you're interested in collaborating with a reverse home mortgage company in Huntington Beach that will provide you and your loan the respect, care, and assistance you deserve, feel free to reach out to us at 800-345-2041 or click this link to arrange a complimentary consultation.

Retirement Equity Planning

In Retirement, the difference between Good and Great is just a click away!

Today’s economic landscape is prompting numerous homeowners to reevaluate their retirement strategies. The era when individuals could depend solely on social security and pensions is fading. Fortunately, there are opportunities to transform home equity into an extra source of income, enabling homeowners to remain in their residences for as long as they wish.

Allow one of our loan specialists to reveal the keys to mastering the four L’s of financial freedom:

- Lifestyle

- Legacy

- Liquidity

- Longevity

By strategically leveraging the equity in your home, you can open the door to a more joyful and fulfilling life while alleviating financial stress. Contact us today to learn how a Reverse Mortgage could be the ideal solution for creating a brighter future!

A Huntington BEACH REVERSE MORTGAGE IS...

A reverse mortgage in Huntington Beach is a financial solution that allows homeowners aged 55 and above to tap into their home's equity as collateral for funds. This mortgage option serves as an essential financial resource, offering increased flexibility for retirement planning.

Frequently Asked Questions

How The Process Works

1. Education

Talk to one of our Green Monarch reverse mortgage lenders in Huntington Beach CA, to learn if a Reverse Mortgage is right for you.

2. HUD Counseling

The Government requires everyone who applies for a Reverse Mortgage to do a quick, 30 minute, HUD approved counseling session, performed by an unbiased third-party agency.

3. Application Process

Once counseling is completed we will set up a time to meet so we can go over your loan application and provide you with some of the required documents.

4. Receive Funding

Once everything is complete you will receive your money in the payment form you have chosen.

How a Reverse Mortgage IN Huntington BEACH can work for you!

Understanding Reverse Mortgages in Huntington Beach

The most effective way to comprehend reverse mortgages in Huntington Beach is to develop a thorough understanding of how and why this loan option can be advantageous, going beyond just the figures. In today's world, people are living longer, relishing in prolonged and fulfilling retirements. As a significant portion of an individual’s net worth is frequently embedded in home equity, more homeowners are turning to reverse mortgages to enhance their cash flow, allowing them to fully enjoy their retirement years.

Crafting a strategic plan for the future can not only assist in managing expenses like healthcare, home improvements, or supporting family members but also enable you to explore opportunities for leisure, enjoyment, travel, or even that coveted luxury “toy” you’ve always yearned to have! Discover the potential that a Reverse Mortgage can provide you today!

Reverse mortgage Calculator in Huntington Beach

The rise of reverse mortgage calculators in Huntington Beach, Orange County, and across California has become strikingly common in the lending sector. Essentially, you're just submitting your personal details, which then ends up on a marketing list, leading to a surge of emails, text messages, and an overwhelming number of flyers and brochures about reverse mortgage loans and providers in Huntington Beach. Concerning the reverse mortgage calculator, we believe that it often does more harm than good.

Refinancing Your Reverse Mortgage IN Huntington Beach

Discover the potential of refinancing your reverse mortgage in Huntington Beach with Green Monarch.

As an independent lender, separate from banks or large mortgage corporations encumbered by high overhead costs, we are able to offer the most competitive reverse mortgage rates in Huntington Beach.

One of the key advantages we provide as an Orange County reverse mortgage company, is our access to a wide range of reverse mortgage programs throughout California, featuring over 50 distinct loan options.

Many lenders limit their choices to programs from their corporate headquarters, often overlooking other viable solutions. What if there’s a much better reverse mortgage loan available that you’re unaware of due to your lender’s restricted product selections? Consider the potential savings you could be missing out on.

So, what are the costs involved in refinancing a reverse mortgage in Huntington Beach, California?

In most instances, we can tailor the new loan to ensure there are no hidden fees when refinancing your reverse mortgage in Huntington Beach with Green Monarch. We also specialize in refinancing jumbo reverse mortgages in Huntington Beach, CA.

If you’re eager to learn more about the top programs and best rates for refinancing reverse mortgages in Huntington Beach, don’t hesitate to reach out to us at 800-345-2041—we’re here to help!

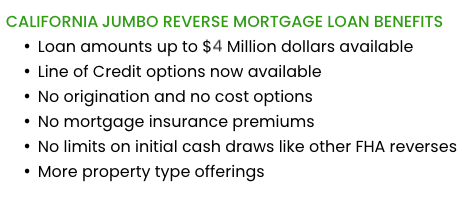

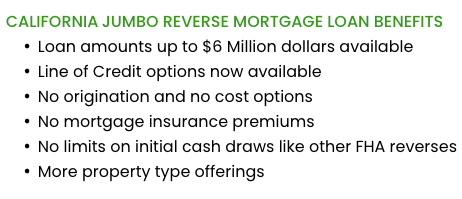

REFINANCE YOUR JUMBO REVERSE MORTGAGE IN Huntington BEACH

If you are looking for a top rated lender to

refinance your jumbo reverse mortgage in Huntington Beach CA, look no further than Green Monarch. We are a fully licensed and qualified

California jumbo reverse mortgage lending company.

With jumbo reverse mortgage loans, you are not required to make monthly mortgage payments. All funds you receive are completely tax-free. Let your home equity enhance your financial well-being.

Jumbo Reverse Home Mortgage Refinancing

You have the option to refinance Jumbo Reverse Home Mortgages in Huntington Beach with any mortgage company across California, but why not select us? We provide access to all the jumbo reverse mortgage loan programs available in the state, offer some of the most competitive rates, and will manage your jumbo reverse mortgage refinance with the utmost care.

We are confident that you won't discover another jumbo reverse mortgage lending company in Huntington Beach that will work as tirelessly, invest as much effort, and truly care about dedicating the time necessary to find the perfect jumbo loan program tailored to your needs. We hope these are the kind of individuals you desire by your side to help secure a financially sound retirement for you and your family. Reach out to us; we would be delighted to speak with you.

#1 RATED

CUSTOMER SERVICE