REVERSE MORTGAGE LENDER CALIFORNIA

Find the best insider information from a reverse mortgage lender California residents should all know about! Green Monarch is a professional and reputable California reverse mortgage lender, whose success has come from providing the most personalized advice and unparalleled customer support in the industry.

JUMBO REVERSE MORTGAGE LENDER CALIFORNIA

What distinguishes a company as the leading conventional reverse and top jumbo reverse mortgage lender California homeowners can call on? Having the Integrity to do business with a client's best interest coming first and foremost, at all times, is what we believe. If you want to find the most trustworthy, hardest working reverse mortgage lender California has to offer, then we hope you continue reading. If you take the decision of what lender you choose to work with as serious as we do, then we would love to speak with you, so you can see for yourself what sets our company apart from other reverse mortgage lenders in California.

Why Choose Green Monarch Reverse Mortgage?

Green Monarch, a premier reverse mortgage lender in California, sets the standard for securing a new reverse mortgage or refinancing an existing one. Unlike larger banks or mortgage companies burdened with significant overhead, we are an independent, family-operated boutique lender.

With a wealth of knowledge and experience comparable to any other in the industry, we leverage our streamlined operations to offer our clients the most competitive rates available. What our clients appreciate most is our ability to provide reverse mortgage loans at zero cost! This also includes

California Jumbo reverse mortgages.

continue ⬇︎

Best Reverse Mortgage Rates in California

We offer the most competitive reverse mortgage rates in California. But the true reason to connect with us goes beyond that: NO OTHER REVERSE MORTGAGE LENDER IN CALIFORNIA will commit to working as hard for you as we do. If you understood that our company can secure the best reverse mortgage loan rates for you without charging a single penny out of pocket for refinancing, wouldn’t you reach out? The answer is straightforward... trust! You may not know or trust us yet, and that’s precisely why you should give us a call.

There’s no pressure here—we’re just honest, friendly folks eager to help. All we ask is for the chance to have a conversation. We’re real people, just like you. While we can provide the lowest reverse mortgage rates in California and no-cost refinancing services, what truly distinguishes us from other California mortgage lenders is the genuine care we offer! We prioritize our clients’ well-being more than any other lender in the state. It’s easy to do the right thing when you genuinely take the time to know and appreciate your customers.

continue ⬇︎

Did you know that California homeowners have access to over 50 different reverse mortgage loan options? If you're interested in learning more about our company and the integrity we uphold in assisting our clients with what we believe is morally and ethically right, then we invite you to discover why Green Monarch removed the California Reverse Mortgage Calculator 2025 from our website. This will provide you with valuable insights into our operations and set us apart from our competitors.

Let us pose a question: would you prefer to collaborate with a company that dedicates quality, personalized time to build a relationship with you, or one that sees you merely as a number generated by an online California reverse mortgage calculator? We aim to engage in meaningful conversations to ensure that we align your specific needs with the best available reverse mortgage loan options. Many lenders in California begin their relationships by directing potential clients toward a reverse mortgage calculator, a tactic we view as a sales gimmick designed to secure more qualified leads for their sales teams. Some mortgage companies pursue leads so aggressively that they promote ads enticing you to utilize the calculator, all for the sake of generating more leads.

Really? No personal information whatsoever? A reverse mortgage represents a significant financial choice for you and your family! When executed properly, it can profoundly impact individuals during their retirement years. If you're still uncertain, we encourage you to call us, and we also recommend reading an article penned by the President of Green Monarch, detailing our perspective and the steps we've taken regarding the Reverse Mortgage Calculator 2025 in California. Afterward, we hope you'll consider reaching out to say hello! If you believe we're worth a conversation, feel free to call us now at 800-345-2041, or if you'd prefer to explore our calculator story first, you can do so by clicking the link below.

Retirement Home Equity Planning in California

The difference between a Good and Great Retirement in California is just a click away!

In today's world, many homeowners are seeking a convenient method to transform their financial assets into a reliable income stream. Like many Americans, you likely aspire to remain in your home for a lifetime while ensuring your finances remain stable throughout.

Our mortgage company is here to assist! Success revolves around mastering the four Ls of financial freedom: Lifestyle, Legacy, Liquidity, and Longevity—and we can guide you through this process!

Effectively leveraging the housing wealth you've built over the years can lead to a fulfilling and carefree life, free from financial stress. Once you grasp the advantages of a California reverse mortgage and its functionality, you'll quickly discover how it can be the key to a comfortable future!

There are Major Differences between Loans...

Compare Below and Find the Best Solution for You!

HECM Reverse Mortgage

Now in its 32nd year, this program has empowered millions of seniors to enhance their retirement outlook. The HECM transforms home equity into tax-free funds, offering a low-interest Line of Credit that can grow without the necessity of monthly payments.

Given that each individual has unique circumstances and requirements for these benefits, retirement solutions can be customized to suit personal needs. Options available include Lines of Credit, purchasing additional properties, or self-funding healthcare plans. The possibilities are limitless.

Jumbo Reverse Mortgage

The Modern Jumbo Reverse Mortgage program is designed for higher-valued homes, eliminating the value caps associated with the traditional HECM loan and allowing you to access more cash. This program is particularly advantageous for properties appraised at $850,000 or above.

Typically, clients can take full advantage of the benefits, as fees are waived and there is no FHA insurance (MIP) required. The Modern Jumbo Reverse Mortgage has gained considerable appeal among qualified homeowners due to its flexibility and innovative options, such as a growing line of credit.

No Cost / Low Rates

The expenses associated with Reverse Mortgages in California have significantly decreased due to recent changes, new offerings, and the removal of several regulations. In many instances, these costs have been entirely eliminated.

Interest rates are competitive, and in some cases, they even surpass those of conventional home loans.

Regardless of the circumstances, our unwavering mission is to support you in reaching your goals while offering friendly guidance to help you achieve all you aim for.

YOUR RETIREMENT CHOICES

California Reverse Mortgage Loan

Program Features:

- Eliminate mandatory monthly mortgage payments

- Access tax-free cash for your personal use

- Establish a Line of Credit with a built-in growth feature

- Counseling is a requirement

- No penalties for prepayment

- There are limitations on fees

Note - With a conventional California reverse mortgage loan, the borrower must fulfill all loan obligations. This includes residing in the home as your primary residence and covering property-related expenses such as property taxes, fees, and hazard insurance. Additionally, it is the borrower's responsibility to maintain the home.

**This is not tax advice! For tax advice, please consult with a tax professional.**

Leading Reasons to get a California Reverse Mortgage:

- Payoff your mortgage

- Pay credit cards with high interest rates off

- Make home improvements

- Take steps to financial freedom by accessing your liquidity

- Safeguard your investments

- Buy more properties

- Help out family

- Delay Social Security

- Acquire long term care insurance

- Take more desired vacations

**If you have any mortgage questions, please do not hesitate... a friendly mortgage specialist is just a quick phone call away!

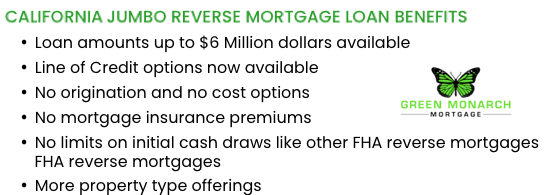

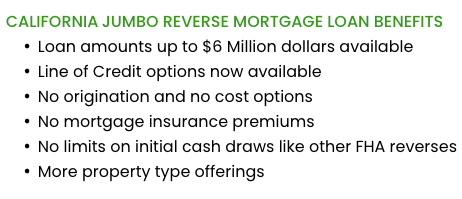

California Jumbo Reverse Mortgage Loan

The Jumbo Reverse Mortgage Program Features:

- You can now get California jumbo reverse mortgage loan amounts up to $6 Million dollars

- There are now Line of Credit options available to you

- No origination and no cost options

- No more mortgage insurance premiums

- Unlike other FHA reverse mortgages, there are no limits on initial cash draws

- The are more property type offerings

Important Note – With a jumbo reverse mortgage loan in California, there are no required monthly mortgage payments. The cash is always tax-free. Help create financial health through your housing wealth.

Best Reasons to get a Jumbo Reverse Mortgage Loan in California:

- Maintain your present Lifestyle

- Pay off your debts

- Make desired home improvements

- Purchase an investment property or vacation home

- Gaining liquidity can help obtain financial freedom

- Help your kids purchase a property

- Help grandchildren with education funds

- Set up a trust fund

- Take care of any costs for in-home care

- Help out in any situation where money is needed to raise kids and grandchildren

REVERSE MORTGAGE COMPANY CALIFORNIA

We continually strive to be the best reverse mortgage company California homeowners can turn to when they need loan assistance, no matter what their situation may be. Whether it be a brand new loan, a refinance of a reverse mortgage or a California jumbo reverse mortgage loan, we are here for you. Expect the highest level of customer support with our company, as we will be dedicated to getting you the best, most fitting reverse mortgage loan for your financial needs.

How The Loan Process Works

1. Educate and Learn

Speak with Green Monarch, a reverse mortgage lender in California, to evaluate and go over your specific needs. You will educate yourself about the benefits to you, your options and costs pertaining to getting a Reverse Mortgage.

2. Reverse Mortgage Counseling

Our government makes sure that all California Reverse Mortgage applicants undergo HUD approved counseling before obtaining your loan. An unbiased, third-party agency will handle such counseling. Your counseling session should only be about 30 minutes long.

3. Loan Application

Upon completion of your counseling, Green Monarch will arrange a best time to meet to discuss your loan application and further assist you in obtaining any required documentation for your loan.

4. Loan Funding

This completes the

Reverse Mortgage process and you will now get your money in the way in which you have decided to receive it.

55

Qualifying Age

If you are 62 years of age and have enough equity in your home, you are eligible.

100%

Tax-Free Cash

It’s your money to spend on what you desire. Do, however, consult with your tax advisor.

Stress Level

Keep your home for the rest of your life! Just pay taxes & insurance and enjoy your life.

Payment Per Month

Put an end to your monthly payments. Instead, deposit cash in right into your account.

How a reverse mortgage in California can benefit you!

In today's world, people are enjoying longer lifespans than ever before, leading many to view retirement as a journey spanning decades rather than mere years. Every year, millions of baby boomers in the United States are reaching retirement age. As they embark on their retirement planning, a significant number are contemplating doing so while still managing a home mortgage, as a considerable portion of their net worth is often tied up in home equity.

Gone are the days when retiring solely on Social Security or a pension was feasible. In the current landscape, it’s crucial to develop a comprehensive plan for the years ahead! Additionally, costs have surged compared to the past; health care expenses, for instance, are significantly higher than they used to be.

A California Reverse Mortgage is a mortgage loan which could give you an answer to the question of how you can create your financial freedom throughout your retirement years.

Securing a home equity loan in California has become increasingly challenging over the years. Nowadays, demonstrating a stable income is essential to validate your ability to make repayments, which can pose a significant hurdle if you've ceased working. Given that you might find yourself living for 20 to 30 years without consistent income, it is prudent to ensure you have access to a sufficient amount of funds.

These scenarios are the reason the HECM program and other Reverse Mortgages were created. They have been specially designed for retirees who are interested in accessing their home equity so they can enjoy their retirement to the fullest. People choose these programs for a variety of reasons but it’s important to note that ANY conversation about accessing home equity for retirement should always include the options of a California Reverse Mortgage and the HECM program!

#1 Rated Customer Service in OC California!

Jumbo Reverse Mortgage Loan Refinance California

The lowest rates, and no cost to you... this is what the

best lender to refinance a jumbo reverse mortgage loan in California will provide for you. Senior homeowners in California have been using

Green Monarch Mortgage in Orange County to get the lowest jumbo loan refi rates in the state, combined with, hands down, the best customer support, all at zero cost to the customer. Green Monarch is located in San Clemente, Orange County, CA and provides traditional reverse mortgage and jumbo reverse mortgage lending as well as traditional and

the best jumbo reverse mortgage loan refinancing throughout the entire state of California.

You are not required to make monthly mortgage payments with jumbo reverse mortgage loans. Any cash received is always tax-free. Let your housing wealth help you create financial health.

Refinance Jumbo Reverse Mortgage California

You can refinance your Jumbo reverse mortgage in California with any lending institution, and we fully recognize how crucial this loan is for numerous homeowners in the state. We take this responsibility seriously. Our team is dedicated and takes the time to understand our clients’ needs, ensuring we always act in their best interest because we genuinely care.

California offers a wide array of

jumbo reverse mortgage

options, and we have access to all of them. Our capability to refinance California jumbo reverse mortgages comes with the promise of the lowest rates in the industry, all without any associated costs.

All we ask is for potential clients to reach out and give us a call. One simple conversation can transform your life! Especially when that call is to a lending company poised to connect you with all the jumbo reverse mortgage refinancing programs available in California. Why take the gamble of working with someone who cannot deliver? If trust is your main concern, that only adds to the reasons you should reach out! Give us a chance to earn your confidence with one call, and you might find either we’re not what you expected, or we surpass those expectations, turning this into the most beneficial financial decision of your retirement. There’s minimal risk in saying hello compared to the significant rewards, right? We’re eager to connect with you!